Live + Work Sustainably

Every Monday, we send you a free email exploring the art of living + working sustainably at the intersection of business, nature, & philosophy.

Together, we’re learning what’s possible to build what’s possible.

Join 7,500+ others exploring the art of living sustainably with the Weekly Ensemble

What is Grow Ensemble?

![]() BLOG

BLOG

Our Latest Articles

We write about & share ways to make change every day—at home, work, or out in your community.

![]() PODCAST

PODCAST

The Social Entrepreneurship & Innovation Podcast

The Social Entrepreneurship & Innovation Podcast is a show about the who, what, why, & how of building a better world.

Through interviews and analysis, Cory Ames explores what a vision for a better world can and should look like.

Listen in and let’s build a better world, together.

60+ 5 Star Reviews in Apple Podcasts, 100,000+ downloads from 160+ countries.

“Always delivers.” ~ Apple Podcasts Reviewer

FEATURED GUESTS

![]() YOUTUBE

YOUTUBE

Our Latest Videos

Catch the latest in social innovation, impact, and sustainable business on video!

Subscribe to Our YouTube Channel »

![]() SHOPPING

SHOPPING

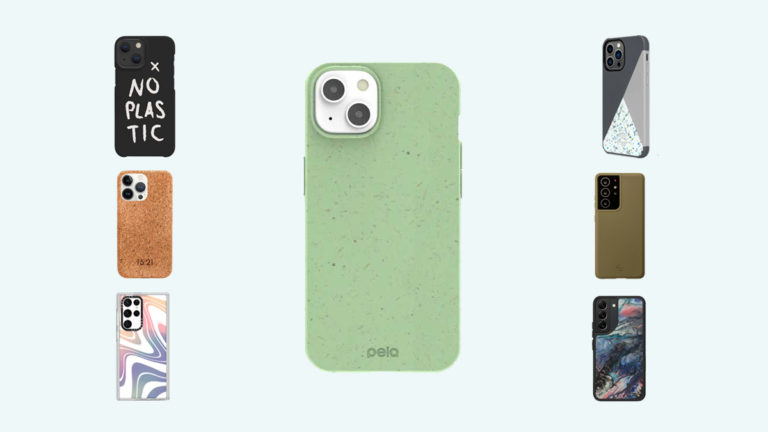

Sustainable Product Reviews

Change the world through how you vote with your dollar. We review & highlight businesses and products that make consuming consciously easier. Check out some of our favorites; our ButcherBox Review, the Best Patagonia Jackets, Bombas Socks Review, or Thrive Market Review.

Or, here are our latest sustainable product reviews…

Visit Our Buy Ensemble Directory »

![]() PARTNERSHIPS

PARTNERSHIPS

Our Partners in Impact

Together, with our Grow Ensemble Partners, we’re driven to build a better world.

What Do You Want To Explore Today?

Get the Weekly Ensemble Newsletter

Every Monday, receive a meditation exploring what it means to live and work sustainably at the intersection of business, nature, & philosophy.

Sign up below to get the next edition in your inbox…