Bonus! Grab Our Guide ‘5 Easy Steps to Switch your Bank’ [PDF]

Want the audio version of this post? Listen here:

Subscribe & Listen: Apple Podcasts – Spotify – YouTube

As the community around social enterprise and conscious consumerism continues to gain momentum there is one unavoidable (but often shamefully avoided) component to the whole movement: where is the money coming from when we vote with our dollar?

We understand that we can build the society we want to live in by spending money with socially responsible companies who operate in a way that aligns with our values, but that effort often starts and stops with spending money.

Is there something else we should be doing before we spend?

Change your bank!

Every dollar that you deposit into your bank goes somewhere. Banks are businesses that need to make money. Often, the social or environmental impact of where these big banks are investing their money is an afterthought to their bottom line.

It’s no news to anyone that “big banks” operate in ways that jeopardize our economic stability for the benefit of their profits, contribute to and strengthen social inequalities, and support environmental destruction by investing in industries like fossil fuels.

So what are we “voting for” when we choose to keep our money with banks like JPMorgan Chase, Bank of America, Citigroup, or Wells Fargo?

Do we want to continue counteracting our own protests of destructive projects like the Dakota Access Pipeline (DAPL) by contributing to these banks?

Good news: we are choosing to support these banks, so that means we can choose not to!

What Defines a “Socially Responsible Bank”?

Socially responsible banks ensure that the money deposited into your bank account gets repurposed and invested in an ethical way.

By focusing on positive environmental, social, and political impact, these financial institutions are making conscious money management a reality and giving people, like us, power to have a say in how their money is used.

This is very different than the facade of “corporate responsibility” that you may see at larger institutions. There are a few certifications that can help you spot true corporate accountability and ethical banking.

There are stringent guidelines for obtaining these certifications, which ensure that a bank is committed to “green banking practices” and positive social impact.

If we’ve said it once, we’ve said it a million times…it’s always nice to see the B! Because B Corp certified companies “are legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment,” this certification provides transparency and accountability.

As an aspiring B Corp, we can vouch for the rigorous certification process and the inspiring community around the B Corp movement. You can search the B Corp Directory here for banking and finance institutions that are B Corp certified.

GABV is an independent network of banks around the work that collectively seek to change the banking system “so that it is more transparent, supports economic, social and environmental sustainability, and is composed of a diverse range of banking institutions serving the real economy.”

You can not only find a GABV bank around the globe with their interactive map, but you can learn about how each bank is using its business to create real, inspiring economic impact.

CDFI certification is for banks, loan, and credit institutions that contribute to the revitalization and investment in the underserved economic communities. The program is a project of the U.S. Department of Treasury, and certification requires financial institutions to join in expanding access to financial services needed for economic development.

![]() GET THE GUIDE: 5 EASY STEPS TO SWITCH YOUR BANK!

GET THE GUIDE: 5 EASY STEPS TO SWITCH YOUR BANK!

Our step-by-step guide for a seamless switch to better-for-the-world banking.

Socially Responsible Banks are Ethical Lenders

Not only do these financial institutions abstain from lending to industries that are detrimental to our environment, but they also avoid investing with socially-harmful companies, like tobacco and firearms manufacturers.

Often, you will also find that these banks integrate sustainable capitalism and socially conscious practices into their own business operations.

Better Banks are Better Community Members!

When you are banking with a socially responsible bank, you are helping make a positive impact in your community. Many of these organizations are vital to funding sustainable and affordable housing for low-income communities, whether through partnerships with outside entities or through investing their own funds.

They are also known for granting loans to our most economically vulnerable communities, allowing for the vicious cycle of poverty to be stopped in its tracks. Sometimes, they do both.

Amalgamated Bank has a community development team that focuses on making economic upward mobility more accessible through grants, loans, and financial literacy education programs. They work with individuals, unions, nonprofits, developers, and community-based organizations to help keep housing affordable and financial resources accessible for marginalized communities.

And while social responsibility is an identifying aspect of socially responsible banks, it isn’t the only benefit!

They Have Lower Fees and More Savings!

Because the sole focus of these institutions isn’t just to make a buck, they can often offer much better perks for their members. “Big banks” tend to have profit-building policies like a minimum balance and a fee if you go below that amount or low interest rates for savings accounts.

But, that is not the case with socially responsible banks and credit unions as they usually offer free checking accounts. Another advantage is that socially responsible banks sometimes offer much higher APY (Annual Percentage Yield).

Savings rates for the big banks are typically .01%—a meager figure in comparison to the 1% that some socially responsible banks offer.

Deposits Are Still Insured

Socially responsible banks enjoy the same insurance protection as their socially-destructive counterparts. Either through the FDIC (Federal Deposit Insurance Corporation) or NCUA (National Credit Union Share Insurance Fund), up to $250,000 of deposits are protected and insured. While this is technically not a requirement of banks, nearly every reputable bank is a member of either federal program.

Banks will proudly communicate they are FDIC insured (and credit unions will do the same with the NCUA!) You don’t have to worry about the safety of your money when banking with an entity that practices socially conscious investing.

4 Socially Responsible Banks & Financial Institutions (and What They Are Doing to Make a Difference)

1. Aspiration

This online neo-bank is a certified B-Corp and fellow 1% for the Planet member. An industry leader in giving back, Aspiration donates 10% of every dollar their customers pay to charity.

Aspiration’s impact is the opposite of what you’d expect from a “big bank.” Not only do they not invest in fossil fuels, but they also have a Planet Protection option. That means when you opt for an Aspiration Plus account, they do some of the world-saving legwork for you, automatically offsetting the carbon emissions for each gallon of gas you purchase with your Aspiration card.

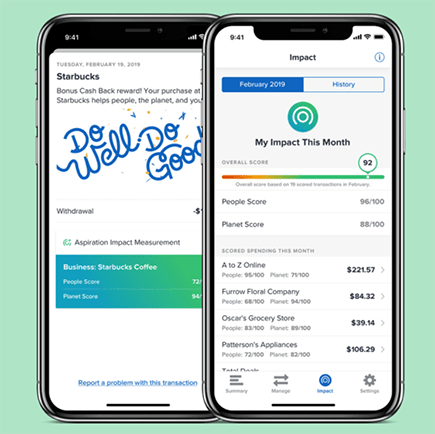

One of our favorite aspects of Aspiration is that it tracks your purchases to give you a personal sustainability score (“an Aspiration Impact Measurement” or AIM) so you can see whether you’re matching your spending with your values. It scores businesses the same way.

When you spend money at a business with a high AIM score, you get up to an additional .5% cashback on your purchase! If you’re a Plus Account holder (*ahem…like us*) you can get up to 10% cashback!

They also offer up to 1.00% APY on their savings accounts and allow for the customers to choose their monthly fees…(blowing the .01% we mentioned for the traditional big banks out of the water).

A few members on our Grow Ensemble team use Aspiration for their personal financial services and love it (check out our full Aspiration Bank review for more). You get $25 if you open an account using our link. We also get a referral bonus, which keeps our Better-World blog and podcast a-kickin’!

Aspiration at a Glance:

- checking & savings accounts

- personal banking

- Up to 5% cash back when spent with a business that is part of Aspiration’s Conscious Coalition for Spend & Save accounts, and up to 10% for Plus accounts

- investment management

- no minimum deposit for checking accounts; $10 minimum deposit for investment and retirement accounts

- choose your own maintenance/service fees for Spend & Save account, $49.99/year for Plus account

- 5 fee-free ATM withdrawals/month

- Online-only account

2. Amalgamated Bank

Based in New York, Amalgamated Bank is both a certified B-Corp and a member of the GABV. Giving homeowners special lines of credit for solar panels, financing community housing, and banking hundreds of political campaigns are just a few of the ways they are strengthening our communities.

They are also leading the way in environmental impact, powered 100% by renewable energy. What they don’t do is equally impressive. Their investments are completely tobacco-free and include zero fossil fuels.

Internally, Amalgamated Bank’s workforce is over 60% women or P.O.C. As a lender, Amalgamated Bank also offers niche lending products to assist their customers in environment and social initiatives. They are also the first bank to raise their minimum wage to $20/hour.

Check out their mission and a full list of the issues they are tackling to see if they may be a match for you.

Amalgamation at a Glance:

- checking & savings accounts

- credit card accounts

- personal and commercial banking

- investment management

- no minimum deposit

- no maintenance/service fees

- 2 fee-free ATM withdrawals/month

- online banking

- Locations in San Francisco, Washington D.C., New York

3. Sunrise Bank

Based In Minnesota, Sunrise Bank is a certified B Corp, member of the GABV, and certified CDFI. It is also a Public Benefit Corporation, which means it voluntarily meets “the highest standards of corporate purpose, accountability, and transparency.”

Sunrise Bank has a large focus on volunteerism, powering North 4 Good, an organization that engages volunteers with volunteering opportunities in the Twin Cities.

Volunteering goes to the core of Sunrise Bank. They give their employees 40 hours of paid volunteer time off.

You can check out their 2018 Impact Report for more data on their social efforts.

Sunrise at a Glance:

- checking & savings accounts

- credit card accounts

- personal and commercial banking

- 2% cash back on debit card purchases (up to $10/month)

- $100 minimum balance

- no maintenance/service fees

- up to $20 in ATM fee refunds nationwide per month

- online banking

- Locations in the Twin Cities

4. Beneficial State Bank

Found throughout the Pacific Northwest, BSB is a certified B-Corp, member of the GABV, and certified CDFI.

Beneficial State Bank is big in the nonprofit banking game, with nonprofits going to the core of their operation including their entire ownership model. Beneficial State Foundation, a nonprofit charitable organization, is the majority owner or Beneficial State Bank.

Majority ownership ensures that betterment of the community is never overcome by pursuit of profit. And, like all owners, Beneficial State Foundation receives distributions of the bank’s profit. Different, and very cool, is that Beneficial State Foundation is required to reinvest those profits back into the communities they serve to support healthy neighbors and a healthy planet for them to live in.

Check out their entire impact portfolio, here.

Beneficial State Bank at a Glance:

- banking services for individuals, nonprofits, and businesses

- lending specializing in environmental and social impact

- credit cards that help build and rebuild your credit

- Apple, Google, and Samsung Pay

- eChecking available with $0 monthly service charge

- online and mobile banking, include mobile deposit

- video banking and access to over 2 million surcharge-free ATMs

- auto loans for new and used purchases and refinancing

- specializing in clean vehicle financing

- Locations in the California, Oregon, and Washington

![]() GET THE GUIDE: 5 EASY STEPS TO SWITCH YOUR BANK!

GET THE GUIDE: 5 EASY STEPS TO SWITCH YOUR BANK!

Our step-by-step guide for a seamless switch to better-for-the-world banking.

Next Actions: Get Started Banking Consciously…

1. Are You Banking Responsibly?

Check to see if you are already banking responsibly. If you are banking with a credit union, for example, you might already be! Credit unions are not-for-profit institutions that are owned by their members.

2. If Not, Let’s Switch! Don’t Be Afraid!

Check out the banks and financial institutions we listed above. A few of us at Grow Ensemble love partnering with Aspiration, but there are plenty of options for you to find what’s best for you and your values.

Our list is not exhaustive. There are hundreds of local banks, certified B Corp banks, and CDFIs that may have what you’re looking for. Click through some of the links throughout the post to find your match.

3. Open an Account at Your New Financial Institution

Just do it. Sign up is easy and often takes less than 5 minutes. If your new bank/financial institution requires a minimum balance, it’s usually low enough to transfer the amount into your new account on the spot.

4. Get the Most Out of Your New Account

Once this first step is taken care of, there’s no need to waste any time! One-by-one, shift over any direct deposits you have set up. That will force you to start using your new card, and that means the start of your positive impact on the world (and getting any benefits offered from your new bank).

Bills, bills, bills. Have auto-payments on bills? Make sure to plug in your new account information. Worry less about the Netflix and Spotify subscriptions, we will address those in a second.

5. Close Your Old Account

Call your old polluting bank and break things off. It’s them, not you. Let them know it’s just not working out. Their obsession with fossil fuels and shareholder primacy has caused a riff. Things with the planet are getting pretty serious, and you’re ready to take things to the next level with a sweeter and more sustainable bank.

6. Cleaning Up Your Subscriptions

Think you may have lingering subscriptions and memberships you’ve forgotten about? Once you close your old accounts, they will reach out to you for updated payment information. This will not only be a great reminder to update with your new account info, but it will also give you the chance to clean house and save a buck or two if you so choose.

REJOICE in the fruits of ethical and socially responsible banking!

Now you can sleep better at night knowing that your hard-earned dollars are being put to good use, making the world a better place (even when you aren’t spending).

If you find a financial partner you like and open an account, let us know how your experience is so we can add to our list and spread the wealth!

Henry Burgess-Marshall

Entrepreneur & Student

Henry is an entrepreneur based out of Seattle, WA. He Co-Founded Maribel, a creative agency, that provides small businesses with marketing, brand strategy, and business development support.

He is an avid reader, writer, and lover of nature, and he is currently pursuing a Masters of Education in School Counseling and Guidance Services from Seattle University.

Your listing and details on socially responsible banks is a great resource. I got here looking for options to be socially responsible as I refinance my home. I have not found anything. The broker I have spoken to says that the way mortgages are sold to Freddi and Fannie and the whole “spaghetti” soup circle of money means that it’s impossible to say if a mortgage or lender is green or responsible or not. True? Got any helpful ideas for me?

I would love a direct response. But please don’t share my email address.

– Jimmy Byrne

One World Home

Hi Jimmy,

We don’t have a direct answer for you, but a great place to look would be the Make Change Blog powered by Aspiration. A preliminary search on our end didn’t uncover anything directly to your question, but I’m sure you can find some helpful direction with a closer look.

If they don’t have the answer you need right now, keep an eye on the Blog and they may have content in the future that gets you what you need. In the meantime, we will put that on our content list for future pieces to dig into. Let us know if you find anything!

– Annie

I enjoyed your article. Do you have a list of banks to avoid? My financial adviser sent me a list of 30 possibilities and asked me if I wanted to exclude any. Citibank for sure I know but the rest….

Thanks !

Donna

Hey Donna,

Glad you enjoyed the post 🙂 From what we’ve read in researching for our bank-related posts, the traditional banks we all know and often have accounts with (Wells Fargo, Chase, Bank of America, and the like) are all worth avoiding from a sustainability and personal finance perspective.

We plan to do some more deep-dive content into finance and banking in the future, so keep an eye out for that. For now, we get a lot of helpful info from Aspiration’s Make Change Blog.

– Annie