Bonus! Get the FREE PDF Nonprofit step-by-step checklist!

So you’re thinking about forming a nonprofit. Maybe you’re passionate about a particular cause, or maybe you’re looking for a sustainable way to help a particular community. Obviously the first question on your mind is: how to start a nonprofit organization? It’s a big step to take, and you’ll need to be informed on many legal, financial, and program-based startup logistics.

But first…Congratulations! Thanks to your efforts, you will be contributing to the betterment of the world!

Some say it’s hard; others say it’s simple. It all depends on the founder’s focus, organization, and dedication to the startup process. It’s all about preparation.

If you’re looking to get your nonprofit started as a side gig and don’t have your ducks in a row as far as what you want to do and who will be involved, it will absolutely be more difficult. If you have the luxury of dedicating serious time and have a clear vision of who will be involved and how, this might not be as challenging for you. Regardless, it’s doable!

We’ll go over the 9 steps of how to start a nonprofit organization to get you started on the right track!

Starting a Nonprofit

We’d like to make one thing very clear upfront: we are not attorneys or accountants. While we are informed on the process and principles of nonprofit formation, we recommend that you speak with an attorney and an accountant to ensure compliance. There are tools and templates out there that can help you through this process on your own, but you’d be taking a risk not getting professional legal advice or guidance to make sure you comply with your state’s nonprofit law.

It’s important to know where to find all of the resources and support you’ll need as you start your nonprofit, and this post is a great start. We are going to go step by step in what you should do before and during the nonprofit formation process.

![]() GET OUR GUIDE: HOW TO START A NONPROFIT, A 9-STEP CHECKLIST

GET OUR GUIDE: HOW TO START A NONPROFIT, A 9-STEP CHECKLIST

A comprehensive and easy-to-follow step-by-step guide to everything you need to know about starting your own nonprofit!

What Do You Need?—Starting a Nonprofit Organization Checklist

As the Founder of a nonprofit, you’ve got a lot of work to do. But, fear not—you can do this! Let’s jump into your guide to getting started.

How Long Does it Take to Start a Nonprofit?

On the legal end of things, forming a nonprofit will take at least six months. It could take longer—from 12 to 18 months—if you are really starting from scratch (for example, you have no clue who could possibly be a member of your board yet).

1. Do the Research

Throughout the research process, be sure to save all of the qualitative and quantitative data you accumulate. It will certainly come in handy as your “base data” when you get into monitoring and evaluating your organization’s work in the future. After all, to measure your impact you need to know what the playing field was like when you started!

Identify the Need

Before you launch into your plans and operations, you have to know that what you’re doing is an effective way to address the issue you have identified.

If you’re thinking about starting a new nonprofit you need to first make sure the work you will be investing your time and capital in is addressing an existing need. As humans, we are inclined to help others, but it is critical to embrace this instinct strategically, assessing what needs others have and in what ways those needs could be best fulfilled.

Let’s take a look at some numbers within the nonprofit sector. There are 1.5 million nonprofits registered in the United States: 45,000 of those nonprofits serve veterans, and 3,500 are animal shelters.

It is very important to see how you align with the work of other already-existing organizations. After all, it may be best to collaborate than to start from scratch. You don’t want to waste your time, resources, and efforts reinventing the wheel.

It is also important to take a look at what other nonprofits are registered specifically in your county, state, or region to determine which, if any, serve as direct “competition” with the work you would like to do. While it may seem odd to think of nonprofits having competition, it is a reality and an important step.

Keep in mind that competition isn’t always bad—you could very well make a bigger impact on the cause you would like to support by partnering with an existing organization or shaping your nonprofit to provide complementary services to those that already exist. Identifying where your nonprofit fits in the existing ecosystem will only make your impact more likely to succeed.

One great way to think about your nonprofit in this context is to complete a Needs Assessment with regard to the community or region you want to serve.

Consider

Consider

It is always helpful to seek out lessons and strategies from people already in the space. For example, have a listen to our conversation with College Forward CEO, Austin Buchan, who talks about his experience analyzing the nonprofit environment to continue building and refining his nonprofit’s strategy and approach to service.

Nonprofit v. For Profit Organization

Any nonprofit organization should have the mindset that they are a business. And in terms of operations, they have many things in common. At the same time, you should know the main differences and benefits that come along with being a nonprofit organization as opposed to a for-profit entity.

Nonprofits get federal tax-exempt status. Nonprofits that are registered as public charities with a 501(c)(3) status (and not just incorporated in their state…more on this later) are exempt from federal income tax. You will still be required to file annual tax paperwork with Form 990.

This tax exempt status will also trickle down to the state and local level. The National Council of Nonprofits provides an overview of the tax-exemption requirements in its Compliance Guide. Always be sure to consult with your accountant to ensure you are in line with these requirements!

Profits go back into the organization. In a for-profit business, any extra profits generally go back to the business owners. In a nonprofit, on the other hand, it is legally required that any extra money be reinvested back into the nonprofit and its programs.

If you’d like to make a profit, you may want to consider becoming a small business or mission-driven company that gives back to the community, like Rahama Wright, Founder of Shea Yeleen, did.

Eligible to receive grants and charitable funding. One of the biggest advantages in becoming a nonprofit is that you are eligible to receive special capital! Public and private funders will ask for your 501(c)(3) registration status when you are applying for grants or soliciting donations.

Read more about this process in the fundraising section below. You may also get some inspiration and insight from our friend, Sarah Woolsey, who spoke with us about her journey from nonprofit to creating a coworking space for socially-minded business people.

Types of Nonprofits

Most often, we assume that nonprofits automatically have 501(c)(3) status. There are actually 29 different tax-exempt statuses with the IRS! Don’t stress—there is a good chance that you will fall into the 501(c)(3) category.

In order to do so, you need to make sure that you:

- will serve a charitable, religious, educational, scientific, or literary purpose;

- will not participate in political campaigns; and

- will not distribute their assets for personal gain or benefit.

Take a look at just a few of the 29 tax-exempt charitable nonprofit statutes with the IRS:

- Federal Credit Unions (501(c)(1))

- To hold titles for exempt organizations (501(c)(2))

- Charitable, Religious, Educational, Scientific, and Literary Organizations (includes foundations who fundraise for other organizations) (501(c)(3))

- Social Welfare Organizations and Social Advocacy Groups (often includes political lobbying) (501(c)(4))

- Labor, Agricultural, and Horticultural Organizations (501(c)(5))

- Trade or Professional Association (501(c)(6))

- Social or Recreational Club (501(c)(7))

- Fraternal Societies (501(c)(8))

- Employee Beneficiary Association (501(c)(9))

- Domestic Fraternal Societies and Associations (501(c)(10))

- Teacher’s Retirement Fund Associations (501(c)(11))

- Cemetery Companies (501(c)(13))

- State Chartered Credit Union and Mutual Reserve Fund (501(c)(14))

2. Clarify Your Purpose & Business Plan

If you want to attract nonprofit board members, starting capital, or potential support, you must have a clear idea of what you want to do and how you want to do it. You must give your community clear reasons to volunteer with or to donate to your cause. Every developing organization should prepare two primary documents: 1) your mission, vision, and values, and 2) your business plan.

It is important to remember that these documents do not have to be prepared in a final version. Once your board of directors is assembled, you will most likely have productive conversations and wise input from your team that will help you iron out kinks. Let that support help you grow in the best ways!

What to Include in your Business Plan

- Executive Summary. While having this document is important, it is also likely that many readers won’t get through the whole thing. This should be the first section, but written last, after the entire plan is ready.

- Mission, Vision, and Values. Your vision is what you want to see in the world, and your mission statement is how your organization will make that happen. This mission can change over time, but you’ll want to let readers know what you think your purpose is.

Keep. This. Short. 20 words is ideal (check out inspirational examples). - Programs, Services, and Impact. So what programs or services will you offer? Who are your beneficiaries? How many are there? What impact will you make? What timeline do you have? Are the programs sustainable? How will you measure your impact? What are your impact-based goals, and how will you achieve them?

- Marketing Plan. Developing your nonprofit’s marketing plan is an essential step. How will you get the word out about your work? How will you communicate your message? What channels will you use? Will you have a website and social media?

- Operational Plan. What will your day-to-day operations look like? Will you have a staff or active volunteers? What will those roles look like? Do you have any legal requirements such as licensing or permits? Will you have an office?

- Financial Plan. What is your financial status? What income is confirmed? What income do you expect? How much money do you need to start, and how much do you need to operate? What startup costs are there? Do you have any gaps? How will you fundraise? Include any balance sheets, financial projections, cash flow statements, etc.

Tip

Tip

- It seems like a lot of elements to include, but keep your business plan as succinct and direct. No jargon. Short, sweet, and to the point!

- Use your base data from the Needs Assessment.

- Keep in mind who your audience would be. You’ll likely be writing for potential donors, board members, and/or partners.

3. Build Your Team

Building your team is an essential startup step, but also a step that will continue long into your nonprofit development process. There are many elements to consider, but let’s start with the basics.

- Will you have a working or governing board?

- Will you have a paid staff?

Building a Board: Working or Governing

First things first: It is a legal requirement for each nonprofit organization to have a board of directors. Putting a board together can be stressful, so keep in mind it could be best to start small and build over time.

Legally, you must have three board member roles: President, Secretary, and Treasurer. As the Founder, you can serve in one of these roles.

The names of the founding board members must be listed on your Articles of Incorporation, and their roles will be stated on your 1023 Form when filing for 501(c)(3) status (read more about that below).

One big decision you need to make is whether you will have a working board or a governing board. What’s the difference?

A Working Board. With a working board, your board members are doing the actual work of the organization. There is no paid staff, and board members carry heavier responsibilities to make sure work gets done—from fundraising to project implementation.

It is critical that in this role, board members are committed to doing the work, not only making important decisions.

A Governing Board. With a governing board, you have a board of directors that oversees the operations, legality, and finances of the nonprofit organization. While board members can take on unique responsibilities or participate in working groups, the nonprofit has a paid staff that performs the day-to-day tasks.

Which board is right for you? If you’re a low budget nonprofit startup with smaller goals in your first year or two, a working board could be a great option for you. This way, you would not have a payroll, but you could get the ball rolling through the work of your dedicated board members and other volunteers who want to support the cause.

Qualities to Look for in a Board Member

You will need to gather a board of directors by the time you register your organization. You will receive a lot of help from board members who can use their diverse skills and talents to make the organization the best it can be.

Finding board members that are the right fit can be a daunting task. Here are some tips on what to and what not to look for in potential board members:

Look for potential board members that:

- are genuinely passionate about the mission

- bring more than just their wallet to the board room (i.e., they want to participate in meetings and activities)

- come from diverse backgrounds and have different specialty areas

- will eventually make up an odd number (this helps when it comes to voting)

You do not want:

- too many family members

- business partners

- board members who are low on time (make sure they realistically have the time and energy to commit to the initiative)

Board v. Staff Roles & Responsibilities

If you decide to have a staff, you will need to balance the roles and responsibilities between the board and the staff members. Clearly stated roles and responsibilities create uniformed boundaries. That prevents your team from feeling like they are being imposed upon or like they aren’t being given the opportunity to contribute.

The board (whether working or governing) must legally have the roles of President, Secretary, and Treasurer. From there you can add additional roles such as Vice President or Member. One important thing to remember is that, no matter what, the board holds legal responsibility—if something goes wrong, the members are legally liable (the staff, on the other hand, is not).

Remember: the board oversees the administration, legality, and finances of the organization.

Keep in mind that the board must:

- Make sure the organization is in good legal standing when it comes to registration and legal documentation;

- Oversee staff by hiring the CEO, mentoring (not micro-managing) staff, and contributing to strategic, fundraising, and/or monitoring and evaluation plans (if a board member is knowledgeable on the specified area); and

- Ensure that the organization is in good financial standing and review financial reports prepared by the CEO.

Board members must also be aware of their legal responsibilities including the duty of care, the duty of loyalty, and the duty of obedience.

On the other hand, the staff is responsible for getting the nitty-gritty done. They must take initiative to:

- Monitor the day to day activity, manage programs, and, of course, perform staff roles;

- Head the majority of fundraising campaigns, events, and marketing efforts; and

- (For the CEO) prepare financial reports to present to the board.

When hiring staff members, the criteria is much the same as choosing your board members. You want staff members who are genuine in their desire to make a difference with an impact job and are passionate about and have time to dedicate to your nonprofit’s mission.

Can I Make Money If I Start a Nonprofit? Who Can Legally Get Paid?

Let’s make this very clear: board members cannot get paid. You will be required to declare this in your bylaws and 1023 Application. People who start a nonprofit are “Founders”, not owners. As such, Founders of a nonprofit are not allowed to make a profit or benefit from the net earnings of the organization. A Founder can get paid if acting in a staff role, such as Director or President. If they are on paid-staff, they can only be on the board as a non-voting member.

4. Register your Nonprofit with your State

State Registration v. 501(c)(3) Status: What’s the Difference

Oftentimes Founders assume that they just need to file for 501(c)(3) status—let’s clarify: you must register your nonprofit as a corporation with your state. The federal government/IRS will treat you as a tax-exempt organization, and your state government will address you as a corporation. Your state tax exemption can be arranged once you have your 501(c)(3) status.

Each state has their own requirements to register the nonprofit as a tax-exempt nonstock corporation. The word “nonstock” simply means that your corporation will not be issuing stocks.

On the other hand, 501(c)(3) status is filed with the Internal Revenue Service using IRS Form 1023 or IRS 1023EZ.

Incorporate the Nonprofit

This incorporation process will be done with the Secretary of State of your state and requires four primary steps:

- Pick a name for your nonprofit

There are three important items to consider when deciding you organization’s business name:

Make sure the name identifies with the work you do and that it is easy to remember. The name of your nonprofit will be essential to your branding.

Confirm that the name is available in your state. States will not permit two organizations to have the same name because they want to prevent a likelihood of confusion between entities. You can usually check what names are available on the Secretary of State’s website.

Registering a nonprofit at the state level is business-like, and one of the following is required at the end of your business name: “Inc.,” “Corporation,” or “Limited.”

2. Create and File the Articles of Incorporation

The Articles of Incorporation is a basic legal document that provides your state with your nonprofit organization’s basic information. While some states offer an online form to submit this information, others let you upload your own PDF. We recommend that an attorney prepares this document for you, though you can find free articles of incorporation templates online as well.

The basic information you will need to gather includes:

- Legal name of the nonprofit

- Name and address of the Founder

- Principal office address (can be home address)

- Name and address of Resident Agent (RA; official person that will receive all correspondence; must live in state where organization is being registered; most often RA is founder or attorney)

- Purpose of organization

- Number of Directors on the organization’s board

- Names of Directors

- Legal statements of organization’s intentions and commitments

3. Pay the fees

The required fee varies by state, ranging from as little as $8 to a couple hundred bucks. This cst cost article gives you an idea of how much registration fees cost per state. Always be sure to check with your Secretary of State for the most up to date fees. If your nonprofit requires additional permits or inspections (like if you’re providing child care services), you will also want to check with the Attorney General in your state who sometimes provides oversight for charitable organizations.

4. Prepare Your Bylaws

Your bylaws do not need to be submitted to your state, but you must have them as an internal document in order to be considered “incorporated.” Your board of directors must come to agreement on these bylaws, and each director must sign.

![]() GET OUR GUIDE: HOW TO START A NONPROFIT, A 9-STEP CHECKLIST

GET OUR GUIDE: HOW TO START A NONPROFIT, A 9-STEP CHECKLIST

A comprehensive and easy-to-follow step-by-step guide to everything you need to know about starting your own nonprofit!

Nonprofit Corporation, Association, or Trust

While most nonprofits tend to register with their state as a corporation, you may opt to register as an association or trust.

According to the IRS, “an association” is an association is a group of persons banded together for a specific purpose.” The association filing requires articles of association to be signed by two individuals who are members of the association.

The other option is to file as a trust, which the IRS defines as “a relationship in which one person holds title to property, subject to an obligation to keep or use the property for the benefit of another.”

5. File for an Employer Identification Number (EIN) with the IRS

After incorporating, you are then required to get an EIN (Employee Identification Number) with the IRS. That’s right—EINs are important for for-profit and not-for-profits. An EIN is basically the Social Security Number of your nonprofit.

The EIN application is not long, but you will want to have the CEO/Founder file, or an attorney can file on your behalf. It is required to file the EIN under one individual’s name using their taxpayer identification number (SSN, ITIN, or EIN).

Once you submit the online application through the IRS website, you will receive your EIN immediately. You will be able to open a bank account with your EIN. There is no cost to obtain an EIN.

Tip

Tip

—Be sure to follow suit with your values as an organization and open your bank account with a socially responsible bank.

—Keep your EIN confirmation page in a safe place, as you will use your EIN to file your 1023 Application and in various financial and legal scenarios.

6. File for 501(c)(3) Status with the IRS

Tax-Exempt Status in the Internal Revenue Code

Tax-exempt status is one of the biggest influencing factors when individuals decide whether to be a for-profit or not-for-profit organization. Becoming a tax exempt 501(c)(3) comes with two major benefits:

- You may be exempt from paying federal and state taxes (such as sales and property taxes); and

- Your donors could get a tax deduction for their contributions.

Remember, there are many (29 to be exact) tax-exempt statutes with the IRS. While most of us think of public charities as the central kind of nonprofit, there are other statutes that will not be able to offer tax benefits to their owners.

You must make sure you fall into one of these categories to be tax-exempt:

- Educational

- Religious

- Charitable

- Scientific

- Literary

- Testing for public safety

- Fostering certain national or international amateur sports competitions

- Preventing cruelty to children or animals

Once you have satisfied the requirements for a tax-exempt classification, there are parameters you must be wary of to keep your status. For example, a 501(c)(3) charitable organization cannot substantially serve the private interests or benefit of private individuals or organizations, and it cannot financially support, endorse, or oppose any political candidates (as there would be conflicts of interest).

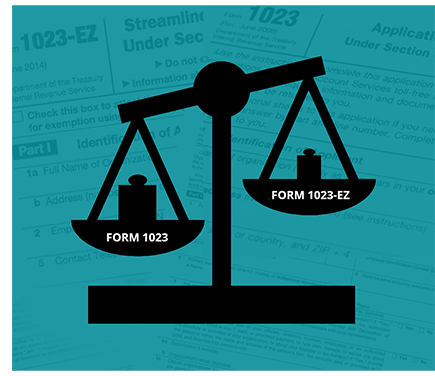

Do You Qualify for the Short Form (1023-EZ) or Long Form (1023)?

The main form you will use to register for tax-exempt status is the IRS Form 1023 (the long-form). The IRS uses this as their standard form.

However, there is another form called the IRS Form 1023-EZ (the short form) that is much more simple and shorter in length. If you can qualify for this form you’ll be saving yourself time and money.

Check with these qualifying factors (starting on page 13) to see if you apply.

Internal Revenue Service Requirements and Timeline

In order to submit your 1023 or 1023EZ tax form you will have to collect several documents. While you can do this yourself, it is much more efficient to have a lawyer handle the application and all of its legalities.

According to the IRS you will need to prepare information on:

- Identification of the applicant (founder), officers/directors/trustees, and basic organization information

- Organizational structure

- Specific activities

- Foundation classification (public charity or private foundation)

The application process can take as little as two months for the IRS to approve your 501(c)(3) designation, or up to one year should there be follow-up questions.

Filing Fees

If you are eligible to submit form 1023-EZ, the filing fee will cost you $275. If you have to apply with the 1023, it costs $600. Payments must be made online through pay.gov at the time of submission.

7. Draft a Fundraising Plan

How Much Money Do You Need to Launch a Nonprofit?

To help others, it is going to cost you upfront in launch fees. You’ll want to keep in mind the basic costs to get yourself official:

- Incorporation with your state (up to $200)

- 501(c)(3) application ($275 for the 1023EZ or $600 for the 1023)

- Professional services fees (attorneys, accountants, etc. for document preparation)

- Any costs related to board recruitment, such as taking potential members out for coffee

After the launch, you’ll want to keep in mind other costs that can add up: Will someone do your branding? Will you create a website? Will you have overhead in an office with paid staff? Will you have a launch fundraiser event? Do your best to think of any potential cost and keep it in mind when creating your fundraising plan.

So, while one of the most FAQs is how to start a nonprofit organization with no money, rest assured that by paying the basic fees and starting out with a working board, you can certainly make an impact while keeping things simple to start.

How to Financially Prepare for a Nonprofit

While all nonprofits will have to pay to incorporate and register for tax-exempt status, the rest of a nonprofit’s financial plan will depend on its unique goals.

A fundraising plan is a central resource for any nonprofit. It serves as a guide for nonprofits to strategically raise funds in an accessible, accountable way. A fundraising plan helps us put our mission into action so that we can make our vision a reality.

A fundraising plan should cover these five core principles:

- Reflect on the past year (the good and the bad; of course this will only apply to existing initiatives).

- Do an intake of current resources.

- Set goals and assess program costs.

- Write the plan (how much funds, where from, how to get it).

- Make it happen.

Best Fundraising Methods

Grants. One of the best advantages of being a nonprofit is that you are eligible for public and private grant funding. You’ll want to take time to look at many sources and research whether or not a grant is a good fit for your work.

Here are some important places you should consider:

- Federal government grants at Grants.gov.

- State and local government grants, which can usually be found on the Governor’s website or your county government’s website.

- Local foundations, associations, or chapters of national organizations such as United Way.

- Databases such as Candid (most will have subscriptions)

- Google search grants that are designated for your type of work, for example, “historic restoration grants” or “grants for homelessness.”

Tip

Tip

Don’t waste your time applying for grants that aren’t a good fit! Invest your time in smart opportunities. Grant writing is a time-intensive process, so use your time wisely!

Events. Hosting a fundraiser is a fabulous way to raise funds and spread the word about your work. Whether it’s a gala, garage sale, or race, you can mobilize staff, board members, and/or volunteers to organize an event.

Be creative and develop some unique fundraising strategies! James Leitner, Founder of MissionCleanWater, has utilized his passion for endurance running and the fact that many in the communities they serve go to great lengths to access clean water to both raise funds and awareness of the issues through their running events. Events can be a great way to educate your audience and raise funds for your work!

Tip

Tip

Be sure event planning does not take over your work! Planning a successful event is important, but working to reach your organization’s mission will always be the most important task.

Campaigns. Short and long-term campaigns are great ways to raise money for a particular event or objective. Think outside the box! Whether you ask local shops to collect change on your behalf or join a platform such as Global Giving to get online donations.

Product or service revenue. Perhaps you’re selling a product to raise money (get crafty!), or maybe your nonprofit is set up with membership fees (for example, offering workshops). This could be a great extra source of income or your entire fundraising model, like Colleen Maggie Clines did in her nonprofit, Anchal.

Startup Grants & Fiscal Sponsors

There is one catch here—you actually need to be registered as a 501(c)(3) and file at least one Form 990 in order to get public (and some private) grants!

For your first year you will want to find a fiscal agent who will act as an entity to support you throughout this process. You can look to local community associations to act as your fiscal agent. They will often charge 5-10% of the money that you receive for acting in this role. In this role, they act as an umbrella organization. They are the legal entity that would legally receive the grant on your behalf and distribute the money to your organization according to your agreement.

8. Set Up Shop

Once you are all official, the fun begins! You get to start doing the work. This passion led you through a tedious process of nonprofit formation, but you made it to the other side—congratulations!

If you decide to go forward with a working board and no paid staff, you will have a more simple pathway to setting up shop. If you decide to go ahead and have an office and paid staff, your process will require extra organization.

Program Costs. It is time to do the work! You will need to consider what investments are needed to start your projects or implement or services, and how much will be needed to sustain them.

Salaries and Overhead Costs. If you’re going to have a staff, whether part-time or full-time, you’re going to have to pay them. Some common roles to start out could be any of the following:

- Executive Director

- Development Director (Event Planner and Grant Writer could be under this role or independent)

- Project/Outreach Coordinator

- Marketing/Communications Coordinator

- Grant Writer, or

- Office Manager

Office Costs. When it comes to having an office, you could open your own or look to local community foundations that rent out small offices specifically to nonprofits. Even if you want to keep it simple, you’ll want to take into account the cost of internet, phones, computers, signage, furniture, and cleaning.

If you decide to go remote, be sure to check out our tips for working remotely. Consider setting up standard practices for your team to make sure you’re operating at max effectiveness to achieve your intended impact. Organization and communication are key for the remote option.

Communication, Social Media, and Website. Your nonprofit is operating, and that is amazing, but the public should also hear about it! You should consider how you will communicate with your audiences (emails, newspapers, webinars, letters, social media, etc).

Online marketing for nonprofits is must in this day in age. Every nonprofit needs social media accounts (Facebook, Linkedin, Twitter, and Instagram if possible) and a website. While social media accounts are free, you will need to make sure someone is in charge of keeping them active. A website and hosting can be very simple and affordable, or you could get a web developer to customize a more in-depth site for you. Utilizing the power of storytelling through these avenues is one of the most effective ways to maximize your nonprofit’s impact, so be sure to plan accordingly.

9. Compliance

Last but not least, you’ll want to make sure your nonprofit stays in good standing. A few things you should consider are:

- File the 990 Form annually with the IRS

- Abide by your bylaws

- Regulate board meeting schedules and minutes

- Pay taxes on unrelated activities over $1,000

- Keep any applicable licenses up to date

![]() GET OUR GUIDE: HOW TO START A NONPROFIT, A 9-STEP CHECKLIST

GET OUR GUIDE: HOW TO START A NONPROFIT, A 9-STEP CHECKLIST

A comprehensive and easy-to-follow step-by-step guide to everything you need to know about starting your own nonprofit!

You Can Do This!

While we wouldn’t call starting a nonprofit organization an easy process, it’s been done thousands of times over. We are confident that with this information you can go forward to form a nonprofit and make real change in the world. Besides (as Teddy Roosevelt conceived), when has anything worth doing been easy?

Going through our checklist on how to start a nonprofit organization and reaching the other side will be one of the most rewarding experiences of your career. Be sure to take these checklists with you as you go through each step and keep your head held high—it will all be worth it! As you build your nonprofit, we would love to hear about your experience!

Kelly Merchán

Contributor

Kelly is a writer and content strategist that is always ready for a challenge and a cup of coffee. She believes that information is a powerful tool that can ignite positive change in communities around the globe.

She is currently based in Ithaca, NY.

Very informative I like it

I would like to set up my own non for profit organization and I very much like the informations I just read

Thanks, Olufemi.

Glad this was helpful for you– good luck getting the nonprofit going!

– Annie

Hey, thanks!

Really glad you found the post so helpful. 🙂

-Cory